"aggregation no disclosure" for commodities

Our philosophy

There is an essential paradox in the commodity markets today: participants want to have reliable prices and other market metrics based on real transactions without needing to disclose their own commercially sensitive data.

Truver brings to the commodities markets its proprietary concept which allows for commercial data

aggregation without disclosing the data of participants.

Technical solutions

“Aggregation no disclosure” or t-and is at the heart of all Truver solutions. Aggregating data from commodity market players without disclosing individual data is based on a patented method powered by

asymmetric encryption and distributed ledger technology.

t-desk is our flagship “on premise” information platform. t-desk allows customer to deploy Truver’s capabilities securely behind their own firewalls, providing enhanced security and automation without the need to disclose commercially sensitive data to third parties. Using advanced AI algorithms t-desk collects and processes all data, generates visual and text analytics as well as indices & trading signals.

Using advanced language processing algorithms, Truver can produce fully automated written analytics based on live data. Users can customise the style, layout, and contents of the reports via t-desk with timely and focused content for better, quicker, more well-informed decision making. t-reports will drastically reduce the time involved in consolidating information for internal decision making processes, automating not only the report writing, but the analysis of the data itself.

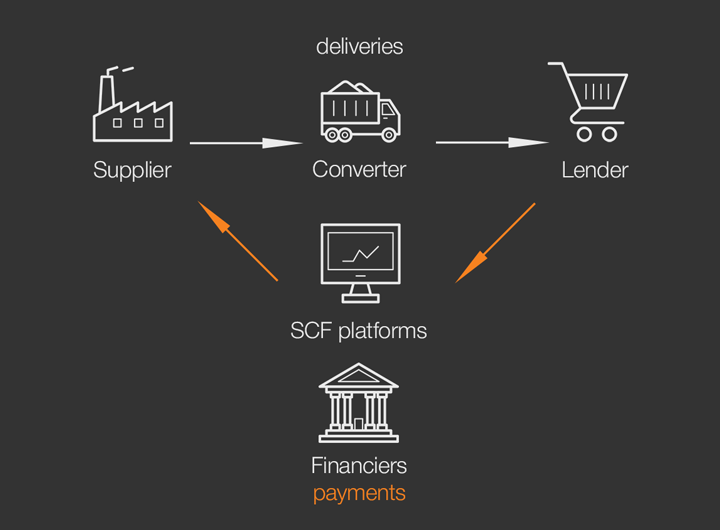

The t-chain combines two contracts between the Commodity Producer and the Converter (Contract 1) and between the Converter and the Lender (Contract 2) into one end-to-end secure contract. The financial terms of Contract 1 are encrypted by t-and, and are not available to the Lenders. The financial terms Contract 2 are encrypted by t-and, and are not available to the Supplier.

Commodities we cover

Crude oil

Crude oil Refined products

Refined products Natural Gas

Natural Gas Coal

Coal Agriculture

Agriculture Polymers

Polymers Chemicals

Chemicals Rubbers

Rubbers Fertilizers

Fertilizers Metals

Metals